Sustainable Investing: A Green Wave Sweeping Global Markets

Verwandte Artikel: Sustainable Investing: A Green Wave Sweeping Global Markets

Einführung

Mit großer Freude werden wir uns mit das faszinierende Thema rund um Sustainable Investing: A Green Wave Sweeping Global Markets vertiefen. Lassen Sie uns interessante Informationen zusammenfügen und den Lesern frische Perspektiven bieten.

Sustainable Investing: A Green Wave Sweeping Global Markets

The world is waking up to the undeniable reality of climate change and its impact on our planet. This awareness is not only driving individual actions but also reshaping the landscape of global finance. Sustainable investing, once a niche concept, is experiencing an unprecedented surge in popularity, attracting investors of all stripes and prompting a fundamental shift in the way companies operate and financial markets function.

A Tidal Wave of Green Assets:

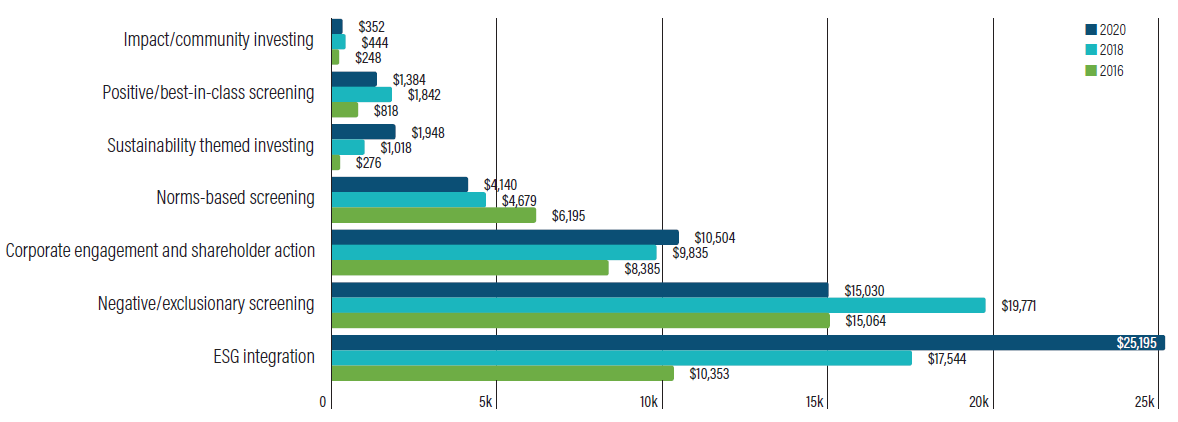

The sheer scale of the sustainable investment movement is staggering. Global assets under management (AUM) in sustainable funds have exploded in recent years, reaching an estimated $40 trillion in 2022, according to the Global Sustainable Investment Alliance (GSIA). This represents a significant portion of the total global AUM and signifies a clear shift in investor sentiment.

The growth is not limited to specific regions or asset classes. Europe, long a leader in sustainable finance, continues to see strong growth, while North America and Asia are rapidly catching up. Investors are increasingly seeking out sustainable investment options across equity, fixed income, and even alternative asset classes like real estate and infrastructure.

Driving Forces Behind the Green Rush:

Several key factors are driving this surge in sustainable investment:

- Growing Environmental Awareness: The increasing awareness of climate change and its devastating consequences is a primary driver. Investors are realizing that their portfolios can be a powerful tool for creating positive change and mitigating environmental risks.

- Regulatory Pressure: Governments worldwide are introducing stricter regulations and policies to encourage sustainable practices and investments. This includes carbon pricing mechanisms, green taxonomies, and mandatory ESG (Environmental, Social, and Governance) reporting requirements.

- Investor Demand: Millennials and Gen Z, who are inheriting a significant portion of global wealth, are increasingly demanding sustainable investment options. They are more likely to align their investments with their values and prioritize companies with strong environmental and social records.

- Financial Performance: Studies have shown that companies with strong ESG performance often outperform their peers in the long term. This is due to factors like reduced risk, improved operational efficiency, and access to a wider pool of investors.

- Technological Advancements: The rapid development of green technologies, like renewable energy and electric vehicles, is creating new investment opportunities and attracting capital flows.

Impact on Companies and Financial Markets:

The rise of sustainable investing is having a profound impact on companies and financial markets:

- Increased Scrutiny: Companies are facing increased scrutiny from investors and regulators regarding their environmental and social impact. This is leading to greater transparency and accountability in corporate reporting and practices.

- Shifting Capital Flows: Investors are increasingly allocating capital to companies with strong sustainability credentials, while divesting from those with poor ESG performance. This shift in capital flows is influencing corporate behavior and incentivizing companies to adopt more sustainable practices.

- Innovation and Growth: The influx of capital into sustainable sectors is driving innovation and growth in areas like renewable energy, energy efficiency, and sustainable agriculture. This is creating new jobs and economic opportunities.

- Risk Management: Sustainable investing is also becoming an integral part of risk management strategies. Investors are increasingly recognizing the financial risks associated with climate change and other environmental and social issues.

- Market Volatility: The transition to a more sustainable economy is likely to create volatility in financial markets. Companies with poor ESG performance may face higher costs of capital and decreased investor confidence.

The Future of Sustainable Investing:

The future of sustainable investing looks bright, with several key trends shaping the landscape:

- Mainstream Integration: Sustainable investing is becoming increasingly mainstream, with traditional investment managers and financial institutions incorporating ESG factors into their investment decisions.

- Data and Technology: The use of data and technology will play a crucial role in driving sustainable investment, enabling investors to access more accurate and transparent information about companies’ environmental and social impact.

- Impact Investing: The growth of impact investing, which focuses on generating both financial returns and positive social and environmental impact, will continue to drive the sustainable investment movement forward.

- Policy and Regulation: Governments and regulators are expected to play an increasingly active role in shaping the sustainable investment landscape, through policies and regulations that promote sustainable practices and investment.

Challenges and Opportunities:

While the future of sustainable investing is promising, it also presents several challenges:

- Data Availability and Quality: The availability and quality of ESG data remain a significant challenge. Investors need access to reliable and standardized data to make informed decisions.

- Greenwashing: The risk of "greenwashing," where companies make misleading claims about their sustainability practices, is a growing concern.

- Measurement and Reporting: The lack of standardized metrics for measuring and reporting ESG performance makes it difficult to compare companies and assess their true impact.

- Transition Risks: The transition to a more sustainable economy will inevitably lead to some economic disruption and job losses.

Despite these challenges, the opportunities presented by sustainable investing are significant. By investing in companies and projects that contribute to a more sustainable future, investors can play a vital role in addressing climate change and creating a more equitable and prosperous world.

Conclusion:

The rise of sustainable investing is a powerful testament to the growing awareness of environmental and social issues. It is reshaping the global financial landscape, driving innovation, and creating new investment opportunities. While challenges remain, the future of sustainable investing is bright, offering a path towards a more sustainable and equitable future for all.